When Fintokei Clients Outperform the Hedge Fund Pros

We say it all the time - everyone has trading talent, you just need to find it. Lukas and Adam are proof of that. What they can do with gold and Nasdaq trades would impress even the pros.

There are more talented traders out there than we realize. The growing number of payouts speaks for itself. At Fintokei, we’ve now paid out over 175 million crowns to our clients. This shows that with the right tools and a bit of knowledge, anyone can achieve great results.

Lukas and Adam are no exception. They’ve been trading on ProTrader accounts for over three months now. They’re not the type to take random risks and burn through accounts. Every trade is planned carefully. They use well-placed stop losses, follow strict money management, and keep an eye on key fundamentals. This is the approach that helps most of our traders succeed.

Top Trades of the First Half of October

When You Outperform the Hedge Fund Pros

Instrument: XAUUSD (Gold)

Trading Style: Intraday

Total Profit: approx. $19,300 (in 4 months)

Gold draws in our clients like a magnet. Almost every trader here has placed a few trades on it. But Lukas is different – he lives and breathes gold. For four months, he hasn’t traded anything else. No wonder he’s got such a great feel for the market.

How does that show? Lukas has a success rate of over 60%, and his profits far outweigh his losses. In short, he knows his strength and sticks to it. One of the top mistakes new traders make is spreading themselves too thin across too many instruments. The best strategy? Focus on what you know and keep getting better. That’s exactly what Lukas did, and now he’s looking at a payout of $19,300. Trading on a $100,000 ProTrader account, he managed to achieve a 19% profit in just four months – nearly double what most hedge funds promise their investors!

Lukas’s skill really shone through on October 1st. He took advantage of the high market nervousness, fueled by the conflict in the Middle East. Gold has been a safe haven for over a year, but in late September, the tension spiked even higher. Israel intensified attacks on both Hamas and Hezbollah, successfully targeting key leaders. It was clear this wouldn’t go unnoticed by Iran, a supporter of both groups, known for its nuclear program and oil production. Any tension involving Iran and Israel boosts market nerves – and gold prices. Lukas saw this opportunity and acted with precision.

Iran launched missiles toward Israel, and Israel responded with defense and plans for retaliation. Gold reacted with a sharp rise, and Lukas was ready. He entered a long position just after 10 a.m., when the market began to slightly correct the earlier surge. You can spot a similar correction on the chart from a few hours earlier, but even that was minimal as gold continued to climb higher.

The market was so tense that gold pushed even further upward. Lukas smartly set his profit target at $2,660, aligned with the previous session’s resistance level. His bet on gold’s rise paid off handsomely. This trade alone earned him approximately $1,500. And people say it doesn’t pay to follow world events!

Size is Power!

Traded Instrument: Nasdaq

Trading Style: Scalping/Intraday/Swing

Total Profit: approx. $30,800

When you have an account worth $400,000, there’s no need to rush. Adam understood this well. He followed strict money management and avoided unnecessary risks. He was content with small gains, just fractions of a percent, but on his ProTrader $400,000 account, even small gains add up quickly.

It didn’t take long for the results to show. After just 10 trades, Adam had already earned over $4,400. His secret? Specializing in the Nasdaq tech index. All his best trades were made on it. Both Adam and Lukas prove that focusing on one market and really digging into it can pay off big time. With patience and careful planning, Adam steadily worked from April onwards, and the result? A payout of an impressive $30,800.

Adam is a bit of a trading chameleon. Sometimes he swings trades, other times he goes intraday, and now and then, he tries his hand at scalping. His versatility makes his trades exciting to watch. The ability to switch between styles gives him a huge advantage – he can wait for the best setups.

Adam’s most successful trades have been swing trades, especially in high-volatility situations. He’s not afraid of volatility, and that’s clear from his decision to trade Nasdaq on September 18, right before the highly anticipated Fed meeting. At Fintokei, we don’t restrict trading during news events, so Adam took full advantage of the situation.

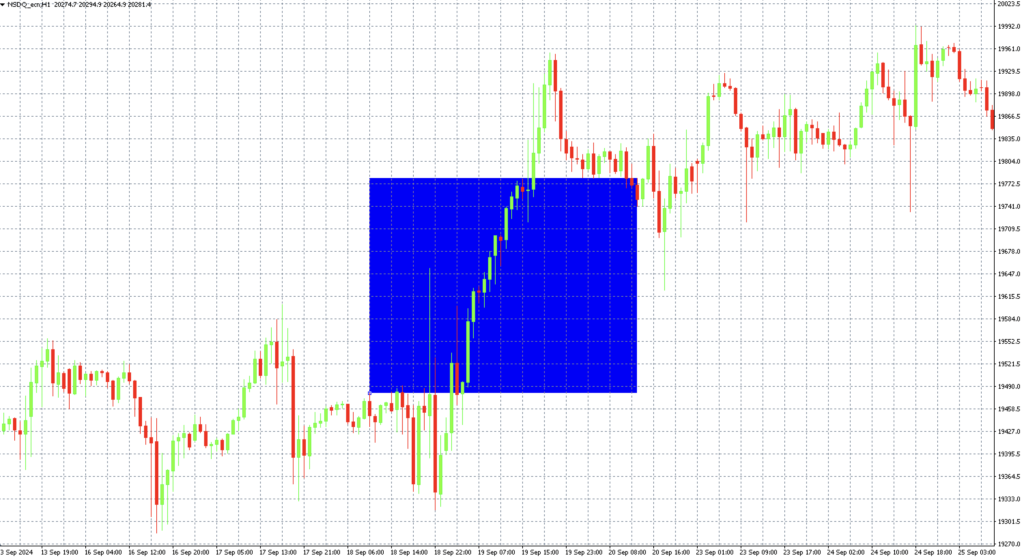

On the day of the Fed meeting, everyone was waiting to see if the first interest rate cut would be 25 or 50 basis points. When the Fed announced a 50-point cut, the markets reacted instantly – and positively. Adam had already gone long on Nasdaq around 10 a.m., hours before the meeting. A bold move, one that might seem reckless, but Adam knew what he was doing. His strict stop loss confirmed that he had planned this trade carefully.If you take a look at the chart above, you’ll notice something interesting. Just before Adam entered the trade (marked by the blue rectangle), the market was hovering at the lower boundary of a strong support level. You can also see two significant dips followed by sharp upward corrections.

If you take a look at the chart above, you’ll notice something interesting. Just before Adam entered the trade (marked by the blue rectangle), the market was hovering at the lower boundary of a strong support level. You can also see two significant dips followed by sharp upward corrections. This pattern hinted at possible manipulation, where the market drops sharply to attract sellers, only to reverse direction and climb back up. This happened twice in a short period, signaling an opportunity to go long. The price then moved toward the upper boundary of the consolidation range.

Note:

Market manipulations like this can typically only be executed by those with massive capital, such as hedge funds or investment firms, often referred to as the big players.

This is where the advantage of having a large account came into play. Adam could enter with a smaller position size, minimizing his risk, while still aiming for high profits. And his strategy paid off. The market continued to climb after the Fed meeting, and Adam held his position for two days, earning a solid $5,700.

Trading the News: Still a Favorite Among Fintokei Clients

And we can’t blame them! Market volatility during news events opens up plenty of trading opportunities. At Fintokei, if your strategy is built to handle the swings and you can manage volatility, we’re all for it. That’s why you’re free to trade the news as much as the platform allows.