3 biggest mistakes of beginner traders

The problems mentioned in this article often stop new traders from completing the trading challenge. The sooner you learn to avoid them, the sooner you will likely pass the challenge and start withdrawing payouts.

Mistake #1 – Trading too many instruments with different strategies

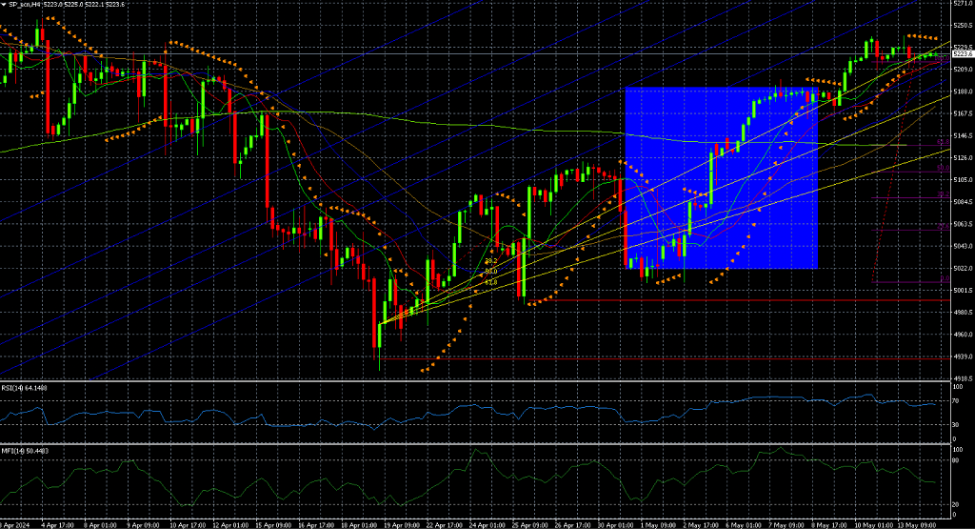

Experienced traders can spot their less experienced counterparts with just a quick glance at their platform. Often, the chart itself is obscured by a clutter of indicators and oscillators. It’s understandable; trading is complex for beginners, and every indicator promising even a slight edge in profitability is tempting to try. The same goes for constantly switching from one strategy or market to another.

However, the starting point should be the opposite – ideally, beginners should focus on one or two instruments and start mastering them. This means studying how these instruments behave in various market conditions, their reactions to fundamental factors, their volatility patterns, and trading them accordingly. The best approach here is to use a demo account with a broker or a trial version of our programs. Both options come at no cost.

The same principle applies to indicators and strategies. Trading is akin to cooking; even the finest recipes can be prepared with just a few ingredients, carefully selected and blended for perfect harmony. Similarly, trading requires simplicity and effectiveness. If you observe experienced traders, you’ll notice their charts are often uncluttered, with straightforward but efficient market entries.

This is also what some novice traders’ trading platforms can look like

Fintokei tip

If you’re seeking a solution to this challenge, we recommend delving into the fundamentals of price action. Mastering this technique enables you to identify trading opportunities directly from a clear chart, making it an excellent foundation for more advanced strategies that you can develop over time.

Mistake #2 – Absence of a trading plan and not tracking executed trades

If reading the description of this mistake makes you grin that you didn’t start trading for some journaling of feelings, then by all means read on. Any seasoned trader will attest that the greatest challenge in trading isn’t mastering technical analysis or timing market entries and exits—it’s grappling with your own psychology, known as the psychology of trading.

Especially for novice traders, transitioning from demo accounts to live trading with real money (even in a challenge) is like entering a whole new realm. Before they know it, detrimental habits like revenge trading, over-trading, chasing losses, or succumbing to confirmation bias creep in. And once these habits take hold, losses swiftly follow, often leading to excessive drawdowns and the premature end of a trading challenge.

Yet, a simple remedy exists—break down your trading strategy into a concrete trading plan and meticulously record all your trades in a trading journal.

How to keep a trading plan and trading diary:

A trading plan for future trades

- What to trade (instrument, market)

- How to trade (time frames for entry or trend identification)

- When to trade (e.g. wait for the US session to start)

- How much to trade (number of trades, amount of daily and total drawdown risk)

Once you have fulfilled your plan for the day (and end up in profit or loss) STOP TRADING, YOU ARE DONE.

Trade diary for past trades

- Date and time of market entry and exit

- Which instrument was involved

- Position size in lots

- Information about the stop loss level and, if applicable, take profit

- Was the trade in or against the trend? (it is not recommended for beginners to trade against the trend)

- Amount of profit/loss

- A few words summarizing your feelings on entry and exit

- Screenshot of the platform during entry and exit

Fintokei Tip:

Begin by writing your trading plan and journal entries by hand, and make it a consistent practice. For instance, just as you prepare a cup of tea or coffee before each trading session, place your journals or notebooks on your desk. Take a moment to review them, contemplate your next moves, and then dive in. It might seem a bit regimented or mechanical, but this is precisely how accomplished traders approach their trading setup post-session.

Mistake #3: Trading Without Stop Losses

It’s astonishing how many traders, not just beginners, overlook setting a stop loss when opening a position. Especially when trading and aiming to capitalize on high volatility during news events (Fintokei allows trading during news events), omitting a stop loss can be disastrous.

You might enter the market with confidence, seeing, for example, a bullish engulfing pattern coupled with current fundamentals signaling a clear uptrend reversal. But if you neglect to set a stop loss, step away for a moment, and return to find the trade has gone awry, it can be a costly oversight. Misinterpreting the fundamentals, combined with volatile market conditions, can lead to significant losses. The difference between losing 10 pips with a stop loss set and 100 pips without one is stark.

A classic example of the market behaving contrary to expectations is the “buy the rumour, sell the news” scenario. Here, traders anticipate a market-moving news release for so long that by the time it arrives, the market has already priced in the information. Consequently, once the news is announced, the market’s reaction is often the opposite of what was expected.

Fintokei tip

Determine the maximum percentage of your account you’re willing to risk per trade (experienced traders typically choose between 0.5% and 3%), and set your stop loss accordingly. Record this limit in your trading journal and adhere to it consistently.

Key Takeaways:

- Start by focusing on one or two trading instruments as a beginner. Choose a suitable price action strategy for trading them and practice on a demo or trial version of our programs.

- Develop a trading plan outlining your strategy and adhere to it consistently in every trading session. Keep a journal to track your trades and periodically review them.

- Always use a stop loss, regardless of the circumstances. It’s a crucial risk management tool to protect your capital.