“I spent my first 2.5 years trading in the red, but I never stopped learning,” says Fintokei Star David

What do you do when you put a big chunk of your savings on a bad signal and lose everything? You either call trading a scam, or you're like David, and take matters into your own hands...

Hi David, welcome among the Fintokei Stars, our top-performing traders! It’s kind of a tradition to start with trading beginnings, so how did it all start for you?

Hi, thanks so much for having me. My beginnings were probably the same as most traders my age. In short, I got lured in by the promises of some “crypto gurus.” You know the type, millions with one click and a Lambo in the garage. Who wouldn’t want that, right? 😀 So I told myself, this is what I want to do.

After that first impulse, a friend and I started putting things into practice. But it was kinda funny. We found this signal provider abroad, a classic copy trading. We knew literally nothing about trading, but we managed to place a trade, and that was enough. The problem was our “guy” didn’t use stop losses, and we didn’t even know what a stop loss was. 😀

Sounds like a recipe for disaster… 😀

You guessed it. A few days later, I started getting SMS messages saying something about a margin call. So I googled what that even was… and then rushed to close the account. Our hard-earned 60,000 CZK (2,400 EUR) was gone, and so was the Lambo dream. I’ll never forget that moment. It hurt.

What happened next?

It wasn’t an easy moment. I’d say 9 out of 10 people would’ve quit and called trading a scam. But I didn’t want to give up. I ditched the signal service and started looking for courses. Learn, learn, learn, that was my new plan.

I spent the first two years bouncing around in crypto and foreign courses. They weren’t verified or famous, but they gave me a foundation. I learned what Fibonacci is, how to work with trends, S/R zones, and the basics of price action.

I spent about 2.5 years in losses like that. But I kept learning. And then a key moment in my trading career came.

What was that moment?

Giving up on crypto and switching to Forex. I was getting really frustrated with those crazy percentage spikes just because someone important tweeted something. I mentioned it to someone I knew, and he told me to forget about foreign courses. “You’ve got the FXCG guys nearby; they teach Forex and have verified results.”

That was the moment it clicked. It made total sense. Why spend money on foreign online courses when I could just drive one hour to Brno and meet my mentors in person? That’s when I closed the chapter on crypto trading and started focusing on Forex.

You’re now the second Fintokei Star who went through the FXCG crew. Last time we had Honza, and he praised their courses too.

Yeah, exactly. Before I met the guys, I was looking for inspiration all over Instagram. The problem was that it influenced me way too much. For example, I’d go long on gold, then see someone else going short. And what did I do? Closed my position and followed his move. And how did it end? Stop loss. 😀

After my first year with FXCG, I had completed all their courses. I was doing well, enjoying it, so I joined their mentoring program. The guys took me into the team, I could watch them trade, and that’s what boosted me the most. I refined my trading plan and got to where I am now.

Today, I’ve been part of FXCG for about 2 years. I help support other traders and mentor them.

Trading is one thing, but helping others, that’s a whole different level. Where do you get inspiration for mentoring?

My strategy is already established. I tweak things here and there when something new pops up, but overall it works well.What I constantly want to improve is trading psychology. A great book is Trading in the Zone by Mark Douglas; it’s a must-have. And for mindset in general, I swear by Mind Power by John Kehoe. I’ve read it several times.

You mentioned your strategy is well-defined. What’s your trading style?

Swing/Intraday. I combine technical and fundamental analysis. I mostly trade gold, but I keep an eye on other commodities and currency pairs too.

Technically, I use clean price action, trends, Fibo, and S/R zones. I don’t need a million indicators. I always laugh when someone sits in front of 20 monitors and says they can’t trade without 30 indicators. Trust me, it works, and maybe better than you’d think. 😀

Looking for a strategy to pass the challenge? Try Smart Money Concepts!

Haha, yeah, we all know those people. 😀 How do you handle risk management?

On virtually funded accounts, I keep risk low at 0.3% on intraday and 0.7% on swing. If I open both positions, I’m still risking max 1%. If I stick to that, the account is nearly impossible to blow up; I’d need an extreme losing streak.

And when a loss does happen?

I try to prevent it. Calm mindset, focus, solid prep. For example, I never enter trades unless I’m at my computer; I’d be breaking my own rules.

But when a loss does come, I treat it as part of the game. I always review it afterwards. I want to know if the mistake was mine or just market chaos.

Favorite quote? “In 12 months, you’ll either have 12 months of progress or 12 months of excuses. The choice is yours.”

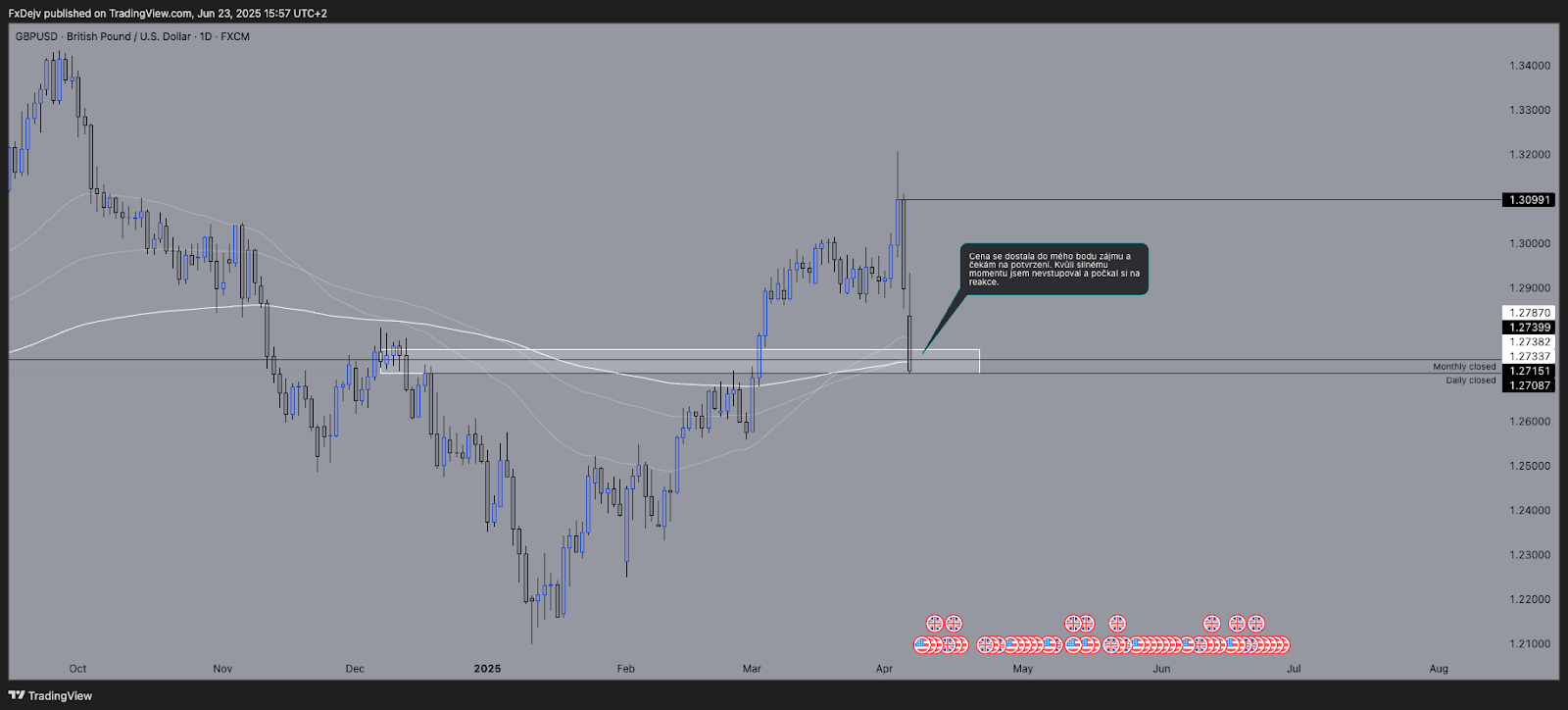

📊 David’s favorite trade: GBPUSD (swing trade)

On the daily chart, I was watching the 1.2700–1.2750 zone. A round number, strong area. I don’t trade impulsively after a momentum candle; I wait for the market to calm down, ideally for a daily candle to close in my direction.

In that zone, all the EMAs (50/100/200) from the FXCG strategy lined up perfectly. And the weekly added a bonus, an FTR candle. I don’t use it as my main confluence, but if it’s there, even better.

On the lower timeframes (M5/M15), I looked for entries on the pullback. I had confirmation from higher TFs, minimal risk, but only if all my rules were met.

Tell us more about your daily routine.

I wake up at 5:30. I head to my home office and do a fundamental overview for the team and Discord community. I check what happened overnight and set alerts.

I’m a big fan of biohacking, red light, and cold plunges. I’ve been doing cold plunges daily for over 500 days. It’s a small morning win that powers me up for the day.

Then I head over to the trading floor with the guys. Mentoring, meetings… In the afternoon, I go through the charts again. I don’t scalp, I use alerts. In the evening, I write in my journal, both trading and personal stuff. It’s great to see that progress in black and white.

Sounds like a packed day. Do you have time for hobbies?

Of course! I love traveling. I actually chose trading because of the freedom; you can work from anywhere with Wi-Fi and a laptop. Trading on vacation is the best, morning trades on a balcony with an ocean view… that’s the dream!

So you’re happy with the trading lifestyle?

Absolutely. My goal was time freedom. Not being stuck in a 9-to-5 job with only 20 days of vacation per year. And I achieved that. So yes, I’m very happy with the trading lifestyle. 💜