Exclusive interview with Fintokei trader of the month: “The hardest thing? Trusting the prop company. But Fintokei totally surprised me.”

How does one of Fintokei's top clients trade? What are his thoughts on prop trading firms, and why is he disillusioned with the current trading community? Read an interview with a trader with a breathtaking payout of $ 48,000 from Fintokei.

While summer might seem like a slow period for trading, our client Robert F. would certainly disagree. This Slovakian trader secured a payout of €48,000 in just two weeks during the height of summer. This achievement ranks him among Fintokei’s most successful clients. Before we delve into his trading strategies, let’s first hear from the trader himself.

Interview with Fintokei trader of the month

Hi Robert, thanks for agreeing to be interviewed for our blog readers and Fintokei clients. Could you start by briefly telling us how you got into trading and how long you’ve been trading?

Hi! My name is Robert, I’m from Slovakia, and I’ve been trading for about 10 years now—five of those as a full-time trader. So, you could say I’ve done my fair share of trading. Funny enough, I actually stumbled into trading by accident after watching a movie.

Let me guess, it was either Wall Street with Michael Douglas and Charlie Sheen or Trading Places with Eddie Murphy and Dan Aykroyd?

You got it – he former is correct, although the latter is a blast too (laughs).

Well, okay, that was the initial push, but how did you educate yourself after that?

At first, I taught myself by reading eBooks, articles, and watching videos and tutorials. But after a while, I realized that investing in myself was the best way to learn, so I decided to pay for some courses. I tried several, especially in different Forex groups. Unfortunately, I was pretty disappointed because most of them turned out to be scams. Over time, you start to see that real traders don’t need to make money by selling courses.

This is also what I find so discouraging about the current state of the online trading community. There are so many “influencers” on social media who claim to have a guaranteed way to get rich by trading. But most of the time, it’s just a scam. The same goes for signal groups that offer to help you pass a trading challenge. Please, if you’re thinking about something like that, don’t fall for it.

You’ve been trading for 10 years. So, in the early days, you must have traded with a broker on a regular trading account, right?

Yeah, I still have an account with a broker. But it’s totally different compared to prop trading.

What do you mean?

Well, to put it simply – when I trade with a broker, 1,000 euros gives me just 1,000 euros to trade with. I have to work hard to build that capital up little by little. If I’m successful, I might make 10% in a year. But with Fintokei, for example, I spent 1,000 euros to get a shot at trading with a 200,000 dolar account. Sure, I had to pass a challenge first, but if you succeed, you suddenly have a lot more money to work with.

So, in your opinion, is prop trading better than standard broker trading?

I wouldn’t say that. There’s a big difference between prop firms. I’ve tried a lot of them, and the quality varies a lot. For example, there were times when a prop firm didn’t pay me, and I’ve even had my account deleted because it was profitable. I admit, I had these concerns with Fintokei too. The hardest part for me has always been trusting the prop firm.

And what reassured you?

Well, getting the payout definitely helped (laughs). But seriously, as I was getting close to the payout and knew I wanted to withdraw, I started reaching out to your support. Right from the first reply, I noticed something different here. No excuses, no complicated terms and conditions, just clear and straightforward information communicated in a human way. To my surprise, you sent the payout the same day I requested it.

Before we dive into your trades, would you like to tell us more about your trading style?

I believe in keeping things simple. I mostly trade EURUSD, AUDUSD, and gold, with the occasional GBPJPY or US30 thrown in. I try to hold trades for a day at most, but I usually prefer scalping. I set my stop loss (SL) based on higher timeframes and adjust it often, and I also shift my take profit (TP) now and then when I’m confident. I generally trade what I see, not what I think, but that’s probably what most traders would tell you (laughs). The main thing is to wait for that perfect setup and not force trades just for the sake of trading.

Analysis of Robert F.’s Most Profitable Trades

Between July 19 and August 5, Robert made 169 trades, with only 58 ending in the red. This Slovak trader focused mainly on scalping currency pairs and gold, though he also held some longer trades. His strategy paid off – 36 of his scalping trades earned between $1,000 and $2,000 each. Thanks to these successful trades, Robert was able to take home a payout of $48,000 in just two weeks.

When Perseverance Pays Off: A $10,800 Trade

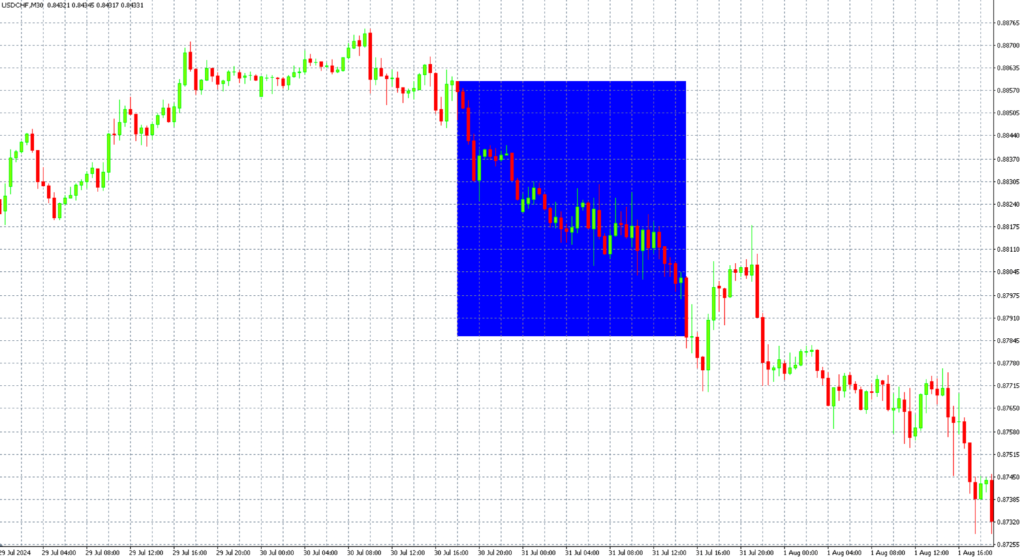

- Instrument traded: USDCHF

- Trading style: Swing

- Profit: $10,800

Robert’s most profitable trade was a bit different from his usual style. While he typically focuses on intraday trades, with positions open for only a few hours or even minutes, this time he held the trade overnight. His patience, along with a well-set stop loss and adjusted take profit, paid off. At the end of July, Robert made around $10,800 on the USDCHF pair in less than a day. So, how did he pull it off?

At the end of July, the USDCHF pair was consolidating sideways, with no clear buying or selling opportunities. However, the wait paid off as a strong downtrend emerged in the following days. Robert timed his entry perfectly, catching the very start of this trend. The focus was on the US dollar, with labor market data and an eagerly awaited Fed meeting drawing attention.

At 16:00, the JOLT (job openings) report showed 8.14 million, the second-lowest since April 2021. This indicated weaker inflationary pressures in the labor market, making an early US interest rate cut more likely. Even the expectation of lower interest rates was enough to weaken the dollar, which is exactly what happened.

Robert took advantage of this by waiting for confirmation before entering a sell position using price action. Less than two hours later, a dragonfly doji candle appeared, signaling a potential trend reversal. His entry was confirmed by a “hanging man” candle, which indicated a downtrend. The risk-reward ratio (RRR) for setting a stop loss at the first resistance and a take profit at the first support was about 1:2, but the actual profit was much higher.

Robert expertly captured the trend direction and, despite the nervousness around the USD ahead of the Fed meeting, held the position until 3 PM the next day. He exited when the market formed another doji candle with long wicks, signaling the end of the downtrend. With just a few hours to go before the Fed meeting, which could have caused significant volatility, Robert was able to sit back, knowing he had made almost $11,000 in less than a day.

How to earn a monthly salary in 18 minutes

We described the first trade as atypical, but Robert truly shines in scalping. With the ProTrader $200,000 account, he can generate impressive profits even with relatively low risk. His trades often last just a few minutes, and his success rate is around 65%, meaning 2 out of every 3 trades he opens end in profit.

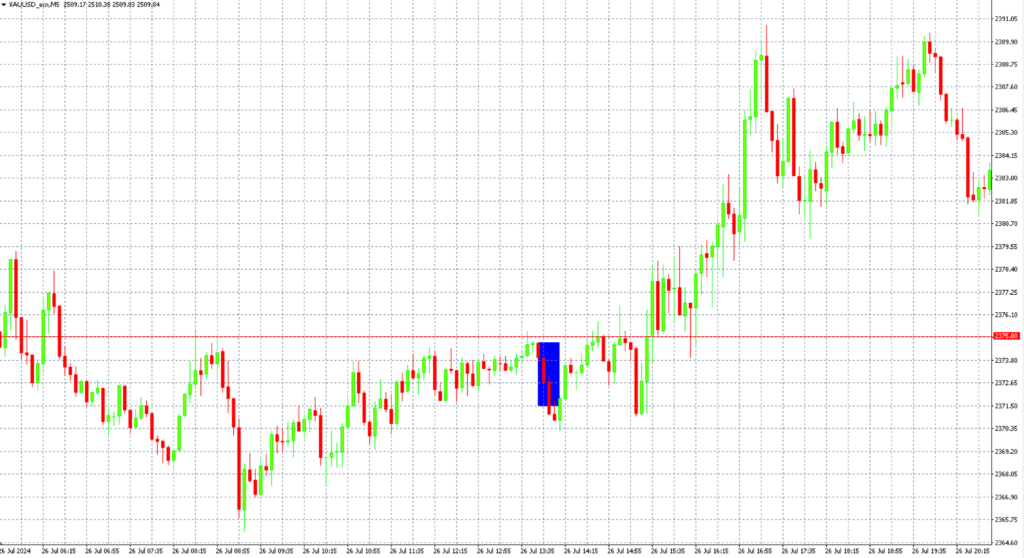

A great example of his scalping skill is seen in his trades on gold on July 26th. On that day, Robert made nearly $ 1,800 in just 18 minutes through four quick trades. Let’s take a closer look at how he managed to pull it off.

The situation on XAUUSD is shown in the chart above. Robert once again used price action principles for his market analysis. At first glance, the chart might have suggested a different outcome. A few hours before entering the trade, a formation resembling an ascending triangle had developed. Robert identified the $2,375 level as strong resistance, crucial for the market’s next move. Gold attempted to test this level several times, but no breakout occurred to confirm an entry into a long position.

Instead, a doji candle formed after touching the resistance, signaling a potential market reversal. After the bounce from resistance and the formation of a bearish candle, Robert entered the market with a short position of 1.5 lots. As the market quickly moved in his favor, he quadrupled his position within seconds. A bearish fair value gap also formed, similar to a situation that had led to a drop to the $2,365 level four hours earlier. Robert exited the position after 18 minutes when the market started to reverse.

Fundamentals also worked in Robert’s favor. As mentioned in the previous trade analysis, weakening inflation leads to lower interest rates and a weaker dollar. If you follow our blog regularly, you know what instruments to watch when trading gold and that the dollar is often negatively correlated with gold. At 2:30 PM on this day, the US PCE inflation data was released, confirming weakening inflation, which weakened the dollar and, in turn, strengthened gold.

As a result, gold broke out of its consolidation and reached values of around $2,390 within a few hours. By that time, Robert had already secured a profit higher than the average monthly wage in Slovakia – all within just 18 minutes.

The Best Investment? In Yourself

These are the words of Robert, a trader whose strategies we’ve explored in this article. However, as he warns, there are many individuals online who don’t have your best interests at heart. Whether they’re self-proclaimed trader-educators with “guaranteed” success formulas or prop firms that promise high payouts but then fail to deliver.

To protect your money, always check the recommendations of others. For example, Trustpilot can be a valuable resource in helping you make informed decisions.