The most successful forex traders

Let’s look at some of the most successful forex traders of all time. What pushed them into the elite league? What strategies did they use? And what can today’s traders learn from their approach?

Forex is the largest and most liquid market in the world. Every day, over $7 trillion is traded. Currency pairs like EUR/USD, GBP/JPY, or USD/CAD react to economic data, central banks, geopolitics, and crowd psychology. No wonder forex attracts thousands of retail traders—but only a few have managed to succeed long-term and consistently.

George Soros

The man who broke the Bank of England

George Soros made history in 1992 when he earned over $1 billion in a single day by speculating against the British pound during the so-called “Black Wednesday.” He bet that the Bank of England wouldn’t be able to keep the pound within the European Exchange Rate Mechanism (ERM)—and he was right. Soros combines macroeconomic analysis with behavioral finance. He believes markets are often irrational and create “reflexive” bubbles that can be identified and exploited. In the case of the pound, it was a fundamental mismatch—high interest rates, a weak economy, and political pressure.

Takeaway:

Macroeconomics is a powerful tool—especially when paired with market sentiment. If you know a central bank is going against the fundamentals (like BoE did), it might be the opportunity of the century.

Bill Lipschutz

The master of market psychology

In the 1980s, Lipschutz was earning tens of millions annually trading forex for Salomon Brothers. Yet he used to say: “In forex, you can be right less than half the time and still make money.” He blended fundamental and technical analysis, with a strong focus on risk management and trading psychology. He understood that currencies are driven by sentiment and expectations—not just facts. He often traded based on expected changes in interest rates and surprises in economic data.

Takeaway:

Psychology is key in forex. Learn to think in probabilities, not certainties. Even the best traders have losing days—it’s all about having a plan and managing risk.

Stanley Druckenmiller

The quiet strategist behind Soros

He was the lead strategist at Soros’s Quantum Fund during the infamous pound short. But even after leaving the fund, he achieved phenomenal results. His hedge fund had profitable years for 30 years straight. Druckenmiller combines macro analysis with aggressive momentum plays. When he finds an opportunity, he goes big—but always with defined risk. He believes the best traders are those who can make a bold bet at the right time.

Takeaway:

Not every setup is worth a big position. But when everything aligns—market trend, central banks, sentiment—don’t be afraid to bet a little more.

Steve Nison

The father of candlestick charts

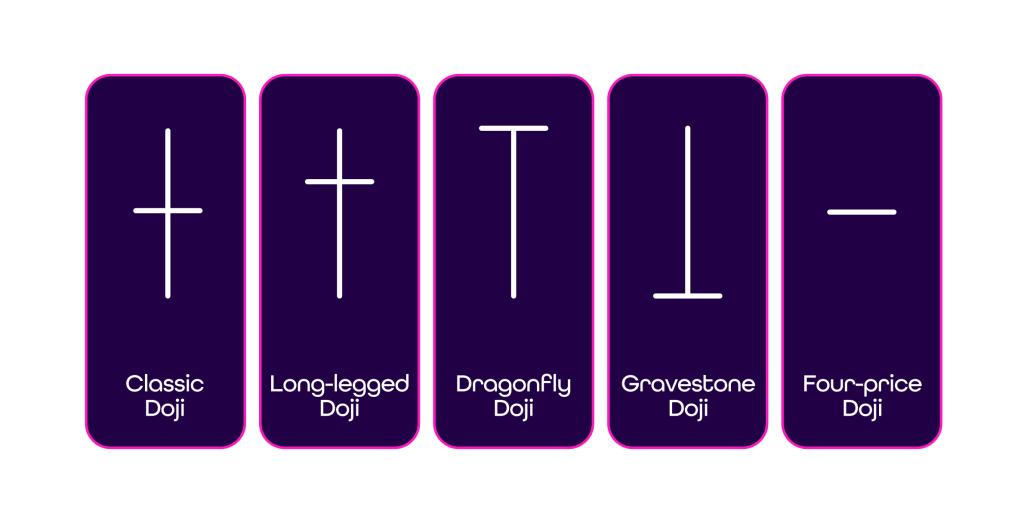

He introduced Japanese candlestick charts to the Western world. His book Japanese Candlestick Charting Techniques revolutionized the way traders read charts—including in forex. Nison showed that technical formations like doji, engulfing, or hammer patterns work well on currency pairs too. Candlestick patterns give clear signals of strength or weakness—often earlier than indicators.

Takeaway:

Charts aren’t just numbers. Learn to read sentiment directly from price action. Forex is ideal for price action strategies because it’s liquid and “clean.”

Doji, source: FBS

Andrew Krieger

The trader who scared New Zealand’s central bank

In 1987, Krieger bet against the New Zealand dollar (NZD), holding a position larger than the country’s total money supply. He made Bankers Trust hundreds of millions in just a few months. Krieger used technical analysis and took advantage of extreme volatility after the October 1987 stock market crash. He realized the market was under stress and NZD was overbought. The trade was short-term but extremely aggressive.

Takeaway:

In extreme situations (like after major stock crashes), currencies can overshoot fundamentals. High volatility brings opportunity—but demands a cool head and tight risk control.

Kathy Lien

The queen of news trading

One of the most respected forex analysts and authors. She worked for FXCM and Global Futures and wrote the bestseller Day Trading and Swing Trading the Currency Market. Her specialty is trading currencies based on macro data and central bank actions. Lien focuses on market reactions to news (like NFP, inflation, or rate decisions). Her style blends short-term news trading with swing trades based on macro trends.

Takeaway:

Watch the economic calendar and understand how currencies react to data surprises. Forex is perfect for active traders who understand the fundamentals and can react fast.