Market Sector Scanner – Middle East Tensions Push Oil Up, USD Rises as Fed Holds Rates Unchanged

Markets focused on the Middle East last week as conflict pushed oil prices higher. The U.S. dollar rose after the Fed kept rates steady. With more key data and Powell’s testimony ahead, traders are watching for the next move.

Geopolitical tensions rose sharply last week as Israel attacked Iran and the U.S. launched airstrikes on Iranian nuclear sites. Oil prices surged early and stayed high on fears of a wider conflict and supply problems. U.S. retail sales were weaker than expected, likely due to tariffs and lower consumer confidence. Stock markets in the U.S. and Japan fell slightly as the Middle East conflict made investors more cautious. The Federal Reserve kept interest rates at 4.25%–4.5% and signaled two possible cuts later this year, but also raised its inflation and unemployment forecasts. The U.S. dollar gained strength, especially against the yen, after the Bank of Japan left its policy unchanged. Gold rose early in the week as a safe-haven but later moved sideways as the stronger dollar led to selling.

Scan for opportunities on:

Key Events Calendar for June 23 – 27

Market Sector Scanner

Forex Market

USD/JPY

Last Week Recap:

USD/JPY had a strong week, breaking out of the long-held 142–146 range. The move was driven by the Federal Reserve’s cautious stance on cutting interest rates and the Bank of Japan’s continued delay of rate hikes due to concerns over the domestic economy. These factors encouraged buyers to step in and push the pair higher.

Technical Picture:

Both short- and medium-term trends are now pointing upward, as traders position for a continued uptrend. In the short term, the pair looks slightly overbought, with price touching the upper Bollinger Band. Watch to see if the previous resistance level at 146 will now act as support.

Outlook This Week:

After trading in a range for some time, USD/JPY now looks set to target a test of the 148 level. Buying on dips appears to be the best strategy this week, though short-term traders may look to sell early in the week if overbought conditions persist.

GBP/JPY

Last Week Recap:

GBP/JPY remained strong last week but struggled to break through resistance at 196, especially after the Bank of England kept interest rates unchanged. The main driver pushing the pair higher continues to be yen weakness, which has outweighed domestic factors in the U.K.

Technical Picture:

The uptrend remains intact, with the 10-day moving average continuing to point higher. Resistance currently sits near the upper Bollinger Band, which may limit gains in the short term.

Outlook This Week:

The overall trend is still upward, so buying on dips is the preferred strategy this week. Selling near resistance at 196 should be considered only for short-term trades.

EUR/JPY

Last Week Recap:

EUR/JPY posted another strong week, driven higher by continued yen weakness as expectations for a Japanese interest rate hike were pushed back. With little resistance on the chart, speculative buying has increased, helping to sustain the rally.

Technical Picture:

The 10-day moving average acted as strong support last week and continues to guide the market higher. The 165 level held firmly again, reinforcing the bullish outlook. The next key resistance is seen at 170.

Outlook This Week:

With the yen likely to remain weak, EUR/JPY is expected to continue its upward trend. However, the market is looking overbought in the short term, so it may be best to stay patient and look for dip-buying opportunities near the 10-day moving average.

AUD/JPY

Last Week Recap:

AUD/JPY traded sideways last week as the Australian dollar came under pressure from Middle East conflict concerns, although yen weakness helped offset the downside.

Technical Picture:

Range-bound conditions continue, with AUD/JPY holding within the 91.50–95.00 range. The 10-day moving average has flattened, suggesting a lack of momentum. Selling pressure may start to build near the 95 resistance level.

Outlook This Week:

AUD/JPY is likely to remain in a sideways pattern, with a move lower toward the 93 level more likely in the short term. However, any losses are expected to be limited as overall sentiment remains neutral.

NZD/JPY

Last Week Recap:

Another test of the 2025 highs near 88 failed last week, as concerns over the Middle East conflict and its potential impact on the global economy led speculators to take profits and sell into strength.

Technical Picture:

Selling pressure at the upper Bollinger Band was strong once again, and with the 10-day moving average starting to turn lower, a retest of the recent support around 86 is becoming increasingly likely.

Outlook This Week:

The latest rejection at 88 confirms that NZD/JPY remains stuck in a 86–88 range. The preferred strategy is to continue buying on weakness and selling on strength within this range.

EUR/USD

Last Week Recap:

EUR/USD pulled back from its three-year high last week as the U.S. dollar strengthened following the Federal Reserve’s decision to keep interest rates unchanged. Ongoing concerns about the conflict in the Middle East also weighed on euro sentiment.

Technical Picture:

The upper Bollinger Band acted as resistance, prompting a move back toward the 10-day moving average, which held as support. The chart remains constructive as long as EUR/USD stays above the key 1.1400 level.

Outlook This Week:

With the market stalling at three-year highs and the dollar showing signs of strength, range trading is likely in the near term. Traders will be watching for further developments in the Middle East before making directional bets.

GBP/USD

Last Week Recap:

A rebound in the U.S. dollar triggered selling in GBP/USD, which had seen strong gains over the past month. The Bank of England kept interest rates unchanged as expected, but markets are now starting to price in possible rate cuts ahead.

Technical Picture:

Last week’s decline brought GBP/USD back to the lower edge of the Bollinger Band, which is acting as short-term support. However, the 10-day moving average has turned lower, and repeated failures to break above 1.3600 suggest that the uptrend may be losing momentum in the short term.

Outlook This Week:

The market is likely to find some support this week, creating potential for range trading opportunities as traders reassess the outlook for both the pound and the dollar.

Best currency pairs to trade: What to choose and why

Want to know which currency pair is actually worth trading? It’s not just about what’s trending – it’s about what fits your style.

Equities

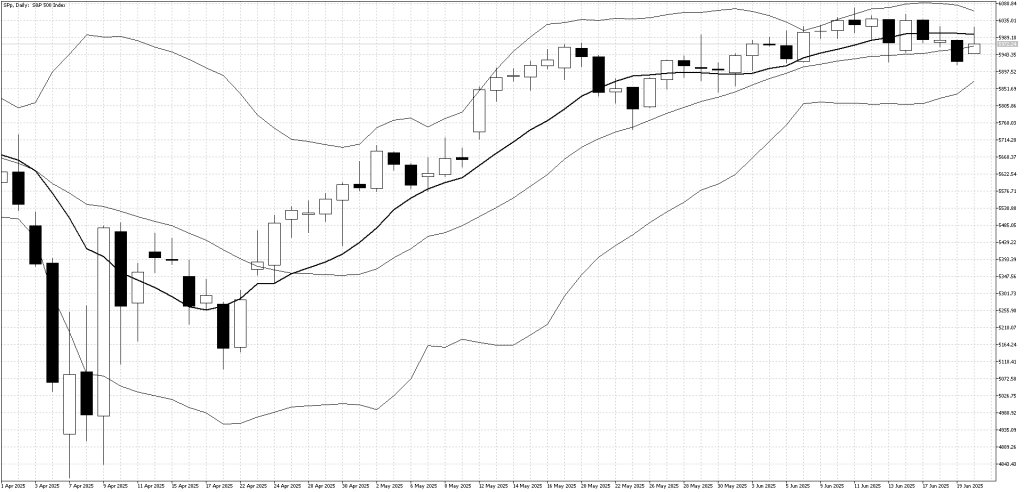

U.S. Stock Market

Last Week Recap:

U.S. equities edged slightly lower last week as escalating conflict in the Middle East—and direct U.S. involvement—was viewed as a negative development. However, the selling remained limited, reflecting underlying confidence in the market.

Technical Picture:

The S&P 500 slipped back below the key 6000 resistance level, and technical indicators have turned more neutral, now pointing sideways. The market will be watching closely this week for a move back above 6000 to avoid deeper selling pressure.

Outlook:

In the short term, the market is likely to trade within a range as investors monitor rising tensions in the Middle East and the potential impact of higher crude oil prices. The medium-term outlook remains positive, with sentiment still supported by broader economic stability.

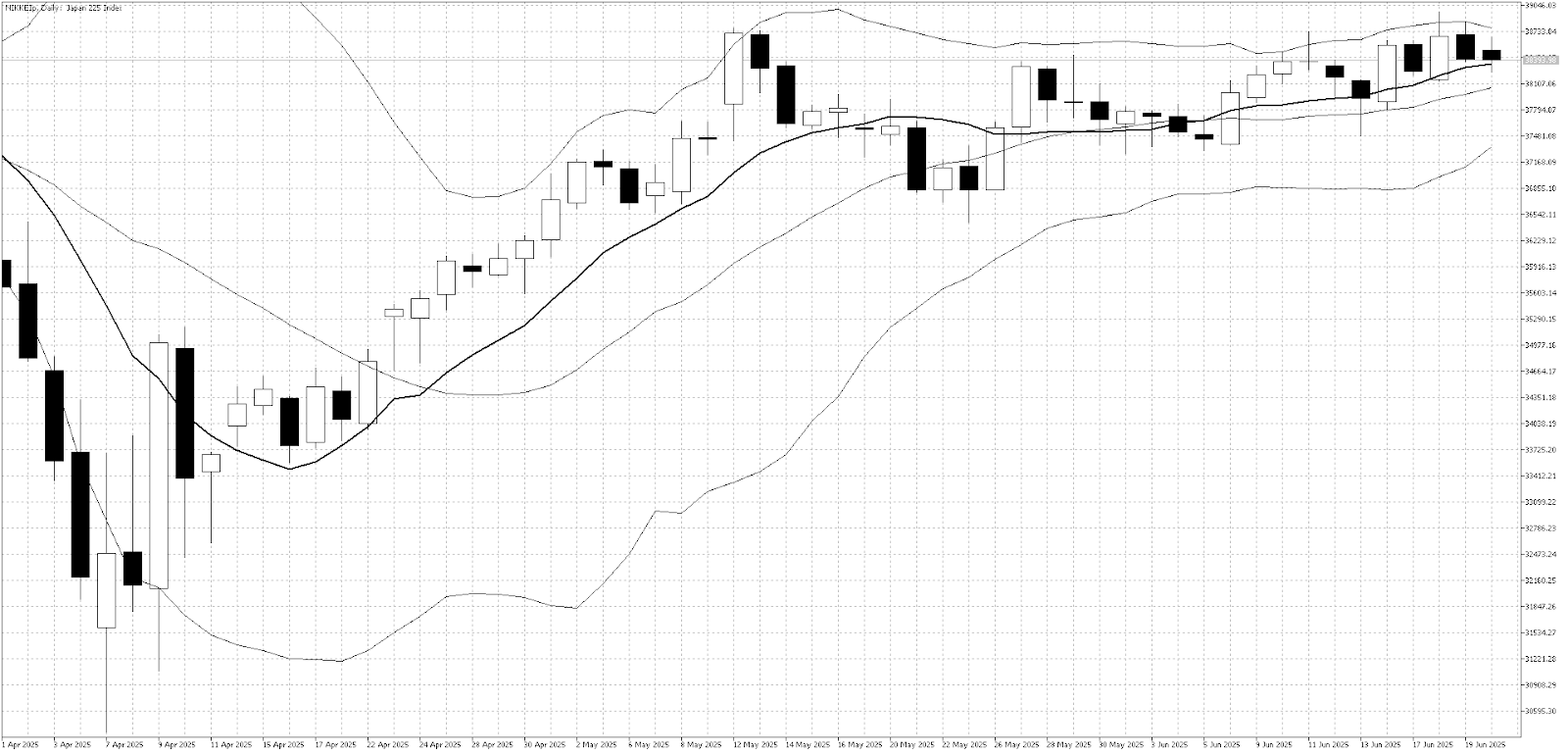

Japan Equities

Last Week Recap:

The Nikkei 225 fell slightly last week as markets waited for progress on a potential trade deal between the U.S. and Japan. The Bank of Japan’s policy meeting was in line with expectations, and continued yen weakness helped limit the downside.

Technical Picture:

The weakening yen continues to provide support for the index. Both the 10-day moving average and Bollinger Bands remain slightly positive, with key resistance still seen at 39,000円.

Outlook This Week:

In the short term, a weaker yen remains a supportive factor, helping to offset concerns about the Middle East and ongoing trade talks. Range trading continues to be the preferred strategy for now.

Commodities

Gold

Last Week Recap:

Gold surged early last week as fighting in the Middle East triggered safe-haven buying. However, as the U.S. dollar strengthened, profit-taking set in, and gold ended the week lower.

Technical Picture:

Gold hit resistance near last month’s highs before pulling back to the 10-day moving average, which has now flattened—suggesting a shift toward range trading. Prices are currently near the middle of the Bollinger Bands as traders focus on headlines from the Middle East.

Outlook This Week:

Gold may test lower in the short term, as much of the geopolitical risk appears to be priced in. While a short-term dip is possible, the medium-term trend remains positive, making buying on weakness the preferred strategy.

Crude Oil

Last Week Recap:

An increase in fighting between Israel and Iran saw crude oil open significantly higher last week. The market then spent the rest of the week consolidating gains, as U.S. involvement and concerns about supply disruptions encouraged more speculative buying.

Technical Picture:

The uptrend remains strong, but the upper Bollinger Band is acting as resistance. In the short term, the market appears overbought.

Outlook This Week:

Crude oil will react to developments in the Middle East, which are difficult to predict. Much of the negative news may already be priced in, so short-term selling opportunities are possible. If the market pulls back toward the 10-day moving average, it could offer a new buying opportunity.

Markets are set for another busy week, with the Middle East conflict in focus. Oil will be watched closely, as more supply problems could push prices higher and hurt investor confidence. This could lead to falling stock markets and rising gold prices. The U.S. dollar has started to recover and may keep gaining if tensions grow. Fed Chair Powell will speak to Congress, and his comments could move markets, especially as President Trump keeps calling for rate cuts. Japan is still trying to reach a trade deal with the U.S., but talks have slowed as Trump focuses on other issues.