Zoom in: Trading fundamentals – How to trade consumer confidence like a pro

If you want to trade news events, you first need to understand them. No worries - that’s exactly what our Focus on Fundamentals series is for. In this third episode, we dive into how to trade consumer confidence data!

Fintokei is one of the few prop firms that allows unrestricted trading during news releases. So why not take advantage of it? In the last episode, we covered how to trade the PMI index. This time, we’ll show you how central bank decisions move financial and stock markets. 🔥 So get your economic calendar ready – let’s go!

What is consumer confidence?

Consumer confidence is an indicator that measures how optimistic (or pessimistic) people are about the future of the economy. Simply put, when people feel secure, have jobs, and expect better times ahead, they tend to spend more. When they are uncertain or expect trouble, they start saving.

In the United States, the two most well-known confidence indexes are:

- Conference board consumer confidence (published monthly, typically at the end of the month)

- University of Michigan consumer sentiment (published twice monthly – flash and final versions)

These reports usually measure expectations around income, unemployment, inflation, car and home purchases, and general consumption. These factors significantly influence personal spending, which accounts for approximately 70% of US GDP.

Why is consumer confidence important?

People’s confidence precedes their behavior. If they begin to fear job loss, they are likely to reduce spending. When this happens on a larger scale, the economy slows down. That’s why consumer confidence is considered a leading indicator of future demand.

Falling confidence can lead to a decline in retail, services, and industry. Ultimately, this could result in weaker GDP growth or even a recession.

💡 Fintokei tip

In the Conference Board report, pay close attention to the “Expectations” component. It is more sensitive to shifts in the economic outlook than the “Present Situation.” If expectations start to decline, it signals that people are anticipating worsening conditions.

Retail sales – hard data behind consumer sentiment

While consumer confidence reflects what people think, retail sales show what they actually do. Retail sales are hard data that measure actual consumer spending in physical stores, gas stations, supermarkets, or online.

In the United States, retail sales data is released monthly, typically in the middle of the month. The reports include:

- Total retail sales

- Core sales (excluding automobiles)

- Real sales (adjusted for inflation)

How do markets react?

Both consumer confidence and retail sales can move markets, especially when the results significantly deviate from expectations. Since consumer spending is such a major driver of the economy, these figures are monitored by central banks as well as stock, forex, and bond traders.

Forex

- Strong data → greater likelihood of economic growth → central bank may raise interest rates → currency tends to strengthen

- Weak data → risk of slowdown → potential rate cuts → currency may weaken

Equities

- Positive retail sales or rising confidence often benefit consumer-related stocks (e.g., Amazon, Walmart, Home Depot)

- However, overly strong consumption may raise inflation concerns → central bank could hike rates → potentially negative for the broader market

Bonds

- Better-than-expected consumption → rising yields, as tighter monetary policy becomes more likely

How to trade based on consumer confidence and retail sales?

Watch the expectations

Markets primarily react to the difference between forecast and actual data. If a 0.2% decline is expected, but the result is +0.8%, that’s a major surprise – and the market will adjust rapidly. The more extreme the deviation, the stronger the reaction.

Look for broader context

What if confidence is rising, but real sales are falling? That could mean people want to spend but currently lack the financial means. It may indicate inflation is limiting consumption or households are increasing their debt levels.

Have a clear plan

Traders should define their strategy before data releases. Identify the market you plan to trade, your entry and exit rules, and key price levels. Know in advance:

- When you’ll take a long position

- When you’ll take a short position

- When you’ll stay out of the trade

Use support/resistance zones or psychological levels to set appropriate stop loss and take profit targets.

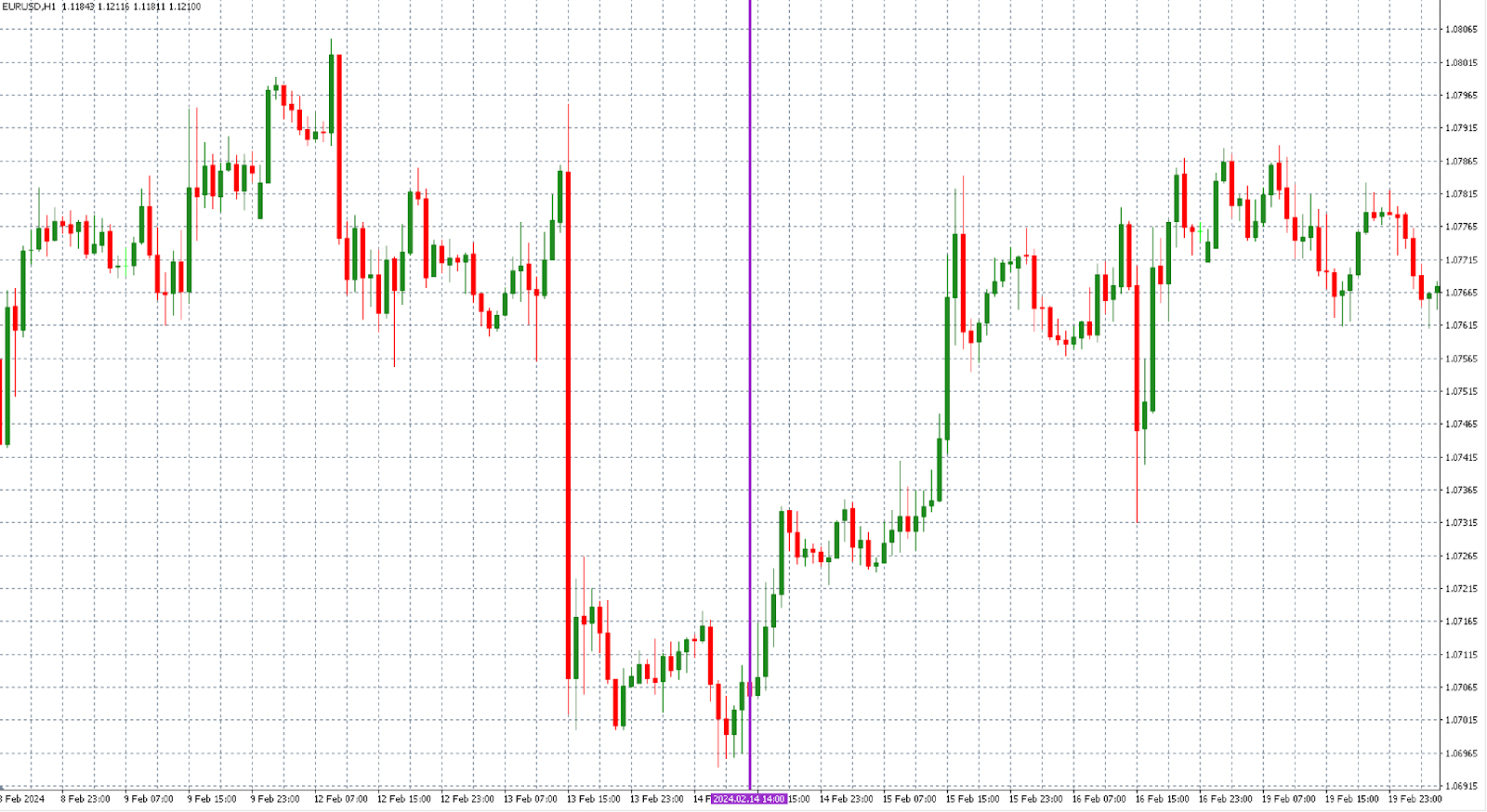

Real-world example: Weak sales trigger dollar drop

On February 14, 2025, retail sales data for January in the US showed a -0.9% decline versus the expected -0.2% drop. It was a sharp disappointment following several strong months.

As a result, the US dollar weakened immediately – traders began to anticipate that the Federal Reserve would soon have to lower interest rates.