Market Sector Scanner: U.S.-Japan Trade Deal Lifts Markets: Focus Turns to Fed

Global stocks climbed on a surprise U.S.–Japan trade deal that boosted confidence and eased tariff worries. Strong earnings and fading rate cut bets supported the dollar, while gold stayed range-bound. Traders now eye central bank meetings, U.S. jobs data, and the August 1 tariff deadline for direction.

The U.S. dollar fell early last week but recovered as traders started to believe that interest rate cuts may be delayed. This shift supported the dollar’s rebound by the end of the week. At the same time, equity markets rose strongly after a surprise trade deal between the U.S. and Japan was announced, lowering planned tariffs on Japanese imports from 25% to 15%. This boosted Japanese stocks – especially car makers – and helped lift U.S. markets like the S&P 500 and Nasdaq to record highs. Strong earnings from U.S. companies and hopes for more trade deals also supported investor confidence. Economic data was mixed, with strong U.S. services numbers but weak manufacturing. In Japan, inflation slowed slightly to 2.9%. Gold rose early in the week due to trade concerns but fell after the Japan deal was confirmed.

Scan for opportunities on:

Key Events Calendar for July 28 – August 1

Market Sector Scanner

Forex Market

USD/JPY

Last Week Recap:

USD/JPY dropped early in the week as it approached key levels. But after a surprise U.S.–Japan trade deal was announced, U.S. long-term interest rates rose, helping the dollar recover. The pair ended the week close to where it started and remains stuck in a range for now.

Technical Picture:

The Bollinger Bands have widened, and the price is sitting near the middle. The 10-day moving average is flat, suggesting there’s no strong trend right now. This points to more sideways movement in the short term.

Outlook This Week:

Both the U.S. Federal Reserve and the Bank of Japan will meet this week. The BoJ has hinted at possible rate hikes later this year, which could strengthen the yen. For now, range trading is likely to continue. In the medium term, buying on weakness still looks like a good strategy.

GBP/JPY

Last Week Recap:

GBP/JPY traded sideways last week, with strong resistance preventing further gains. Weaker-than-expected U.K. retail sales also added pressure, encouraging some traders to sell and take profits.

Technical Picture:

After failing to break above the upper Bollinger Band, the market has moved back toward the center of the bands. This shift suggests limited momentum and a possible drift toward lower prices in the short term.

Outlook This Week:

It’s hard to predict the next major move, as traders await policy updates from the U.S. and Japanese central banks. For now, range trading remains the most practical approach in both the short and medium term.

EUR/USD

Last Week Recap:

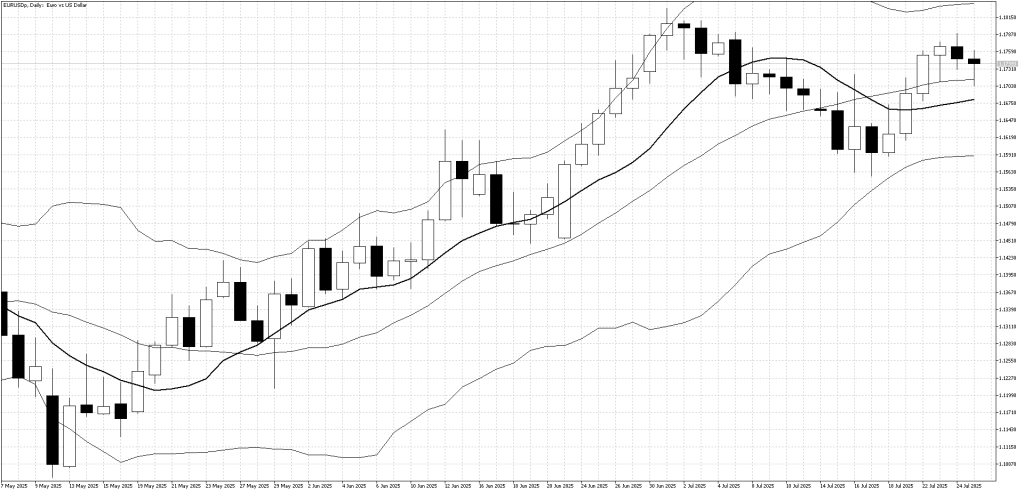

The European Central Bank held interest rates steady as expected, and concerns about a possible U.S.–Europe trade deal helped EUR/USD recover from recent short-term weakness. The pair managed to bounce off its lows and regain some ground.

Technical Picture:

EUR/USD moved back above the 10-day moving average, breaking the recent downtrend. Technical signals now suggest a more sideways outlook, with resistance nearby at the upper Bollinger Band.

Outlook This Week:

EUR/USD may struggle to move much higher this week as traders await the U.S. Federal Reserve’s policy decision on Thursday. Range-bound trading is likely to continue in the short term.

Equities

U.S. Stock Market

Last Week Recap:

The Nasdaq reached new record highs once again, driven by strong U.S. corporate earnings. Markets also reacted positively to the U.S.–Japan trade deal, which gave investors confidence that other countries may reach agreements before the August 1 tariff deadline. This helped support overall risk sentiment.

Technical Picture:

The market remains in a strong uptrend, with the 10-day moving average acting as reliable support during pullbacks. In the short term, the upper Bollinger Band is offering some resistance, but overall momentum remains positive.

Outlook:

The uptrend looks likely to continue in both the short and medium term. However, traders should be cautious of potential surprises from three key events this week: the U.S. Federal Reserve policy meeting, the U.S. non-farm payrolls report, and the August 1 tariff freeze deadline. Any unexpected news from these events could break the uptrend.

Commodities

Gold

Last Week Recap:

Gold tested key resistance levels from May and June early in the week as traders worried the U.S. might finalize major trade deals before the August 1 deadline. But those concerns eased after the surprise U.S.–Japan agreement, and the market ended the week nearly flat.

Technical Picture:

Touching the upper Bollinger Band led to some selling, while the 10-day moving average stayed flat. This suggests the market is still moving sideways without a strong trend.

Outlook This Week:

The medium-term outlook remains positive, and buying on weakness is still the preferred strategy. In the short term, prices will likely stay in a range unless some surprising news comes out.

The biggest focus this week is Friday’s U.S. jobs report, but there are many important events before then that could impact markets. Both the U.S. Federal Reserve and the Bank of Japan will hold meetings, and while no rate changes are expected, traders will be watching closely for hints on when the U.S. might start cutting rates and when Japan could begin raising them. There’s also growing attention on trade talks between the U.S. and Japan, with the August 1 tariff deadline approaching.