Cup and handle: How to spot the chart pattern and use it in trading

Cup and handle is one of the most reliable chart patterns that can help you catch a precise entry into a trade. In this article, you will learn how to recognise this “cup with a handle” shape in charts, how to trade it, and what to watch out for to avoid common mistakes.

What is a cup and handle pattern?

Cup and handle is a technical chart pattern that signals a potential continuation of a bullish trend after a period of consolidation. You will usually find it during an uptrend, and if you read it right, it can offer a very accurate entry point into a long position.

This pattern was popularised by American trader and author William O’Neil, who originally used it for trading stocks. But today, it’s used across markets – forex, indices, crypto, commodities… The pattern is quite universal and relatively easy to read.

Why is cup and handle popular among traders?

- It clearly defines entry, stop-loss, and potential profit levels.

- It’s easy to recognise, even for beginners.

- When combined with volume or support/resistance levels, it offers a relatively reliable signal.

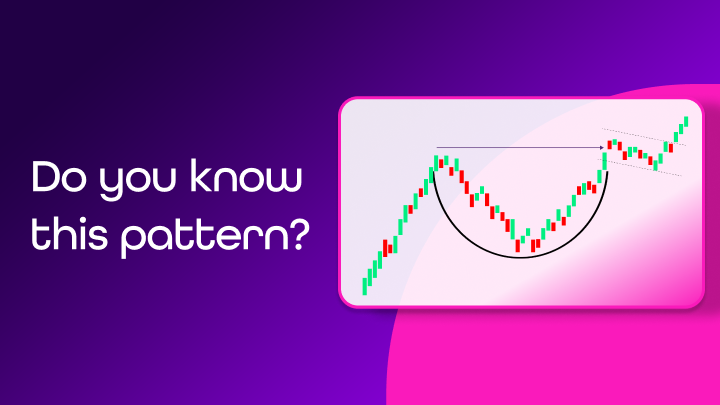

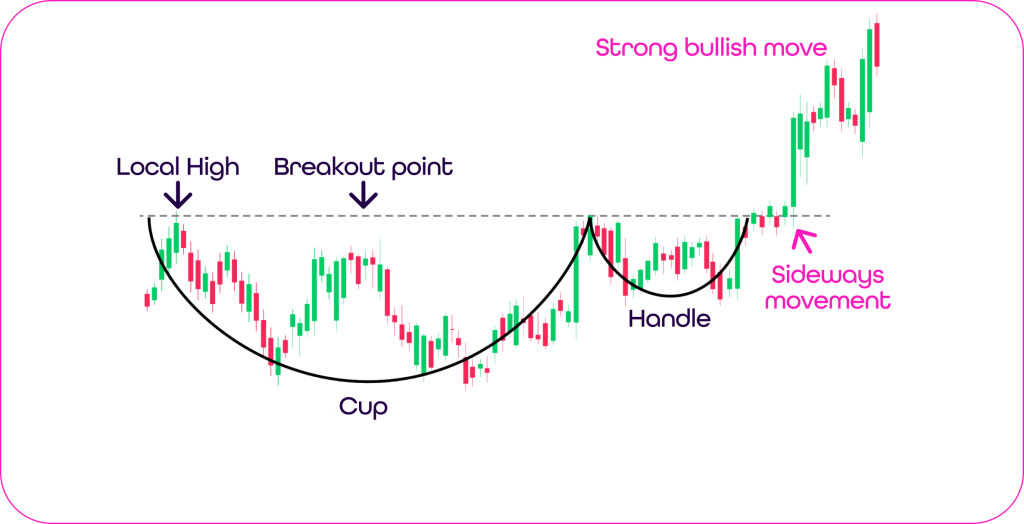

What does a cup and handle chart look like

The cup and handle pattern, also known as cup with handle, consists of two parts:

- The cup

First, the price drops from a local high, forms a rounded bottom, and then climbs back to the previous high. The whole shape looks like the letter “U” (not “V” – that’s important). This move represents a consolidation after a previous rally – the market is “catching its breath.”

- The handle

When the price returns to the previous high, it doesn’t break through immediately, there’s usually a short pullback or sideways movement. This small pause is important because it creates space for new buyers waiting for a breakout.

Once the price breaks above the top of the cup, a strong bullish move usually follows. And that breakout is the main signal to enter the trade.

How to imagine cup and handle in practice

Let’s say you’re watching the EUR/USD pair. The price moved from 1.0900 to 1.1300, then dropped back to 1.1050. Over the next few weeks, it slowly climbed back to 1.1300 – that’s the cup.

- Then came a short pullback to 1.1200 – the handle.

- Next came the breakout above 1.1300 – buy signal confirmed.

Which timeframe does it work on?

The cup and handle pattern tends to give the most reliable results on daily (D1) or weekly (W1) charts. You’ll also find it on shorter timeframes (M15, M5), but it’s often less accurate due to market noise.

💡 Fintokei tip

Do you want to trade cup and handle on the 5-minute chart? You can. But be careful of false signals and always combine the pattern with volume, support/resistance levels, or indicators (e.g. MA50, MA100).

How to identify a valid cup and handle pattern

Not every “U-shape” you see on a chart means you’re looking at a real cup and handle. To make sure the pattern actually makes sense and has trading potential, it needs to meet a few key criteria.

Here’s a checklist to help you avoid unnecessary mistakes:

| Element | What to watch | Ideal scenario |

| Previous trend | The pattern works as a continuation of an uptrend | Clear growth of at least 30% before the pattern |

| Cup shape | Should not be a sharp “V”, but a smooth “U” | Rounded, slow price recovery |

| Cup depth | How far the price falls during the formation | Between 12% and 33% below the previous high |

| Time range | Duration of the formation | Cup: 4–12 weeks, Handle: 1–3 weeks |

| Handle shape | A short pullback or sideways consolidation | Pullback smaller than 50% of the cup depth |

| Volume | Monitor volume behaviour during the formation | Falling during the cup, rising during breakout |

| Breakout | Where the price breaks out | Clear breakout above the top of the cup with volume |

💡 Fintokei tip

If 2 or more points are missing from this checklist, it’s better not to trade the pattern.

Common mistakes when trading cup and handle

The cup and handle pattern looks simple and that’s exactly why many traders get burned by it. These are the most common mistakes that keep happening again and again:

- Entering without confirmation

A lot of beginners jump into the trade as soon as the handle starts forming, just because the pattern “looks promising.” But if the price hasn’t broken the resistance yet, the pattern is not confirmed.

✅ Better approach: Wait for a breakout above the right side of the cup. Ideally, it should come with increasing volume.

- “V” shape instead of “U“

A quick drop followed by a fast recovery. Looks like a cup? Maybe. But a “V” means volatility, not stable consolidation.

✅ Better approach: Watch for a rounded cup and make sure the market is “digesting” the previous rally during the formation.

- Large or overly long handle

Sometimes the handle drags on for a whole month or drops all the way to the cup’s bottom. That’s no longer a handle; it’s a different pattern or even a sign to stay away.

✅ Better approach: The correction in the handle should be quick and shallow. Once it becomes too deep, the pattern loses its validity.

- Ignoring volume

A cup and handle without volume is like flat beer – something’s missing. If there’s no volume during the breakout, it means the market doesn’t really care. And you should stay cautious.

✅ Better approach: The breakout should come with rising volume (or a strong bullish candle, especially if you’re trading forex without volume data).

How to read candlestick patterns? Download our e-book!

How to trade the cup and handle pattern

Alright, you’ve correctly identified the cup and handle pattern. Everything fits – the shape, the volume, the timing, and the trend. Now comes the most important part: how to trade it properly.

Let’s break it down into a few simple steps:

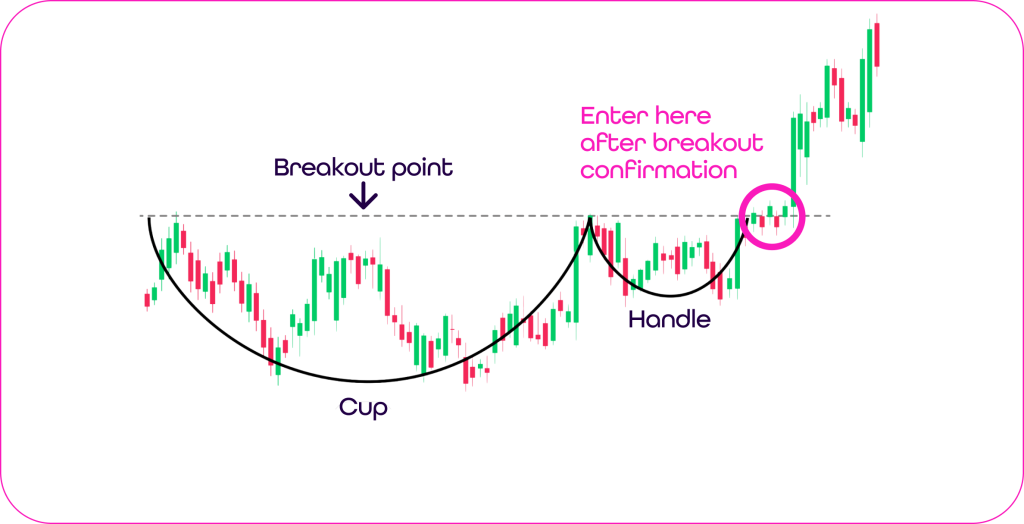

Entry point

- When: As soon as the price breaks above the top of the cup (i.e. the previous high).

- How: Enter either with a market order (after a confirmed breakout candle) or place a buy stop order a few pips above the resistance level.

- What to watch: Rising volume or a strong breakout candle (e.g. bullish engulfing).

Remember: entering before the breakout is pure gambling. The pattern is only valid after confirmation.

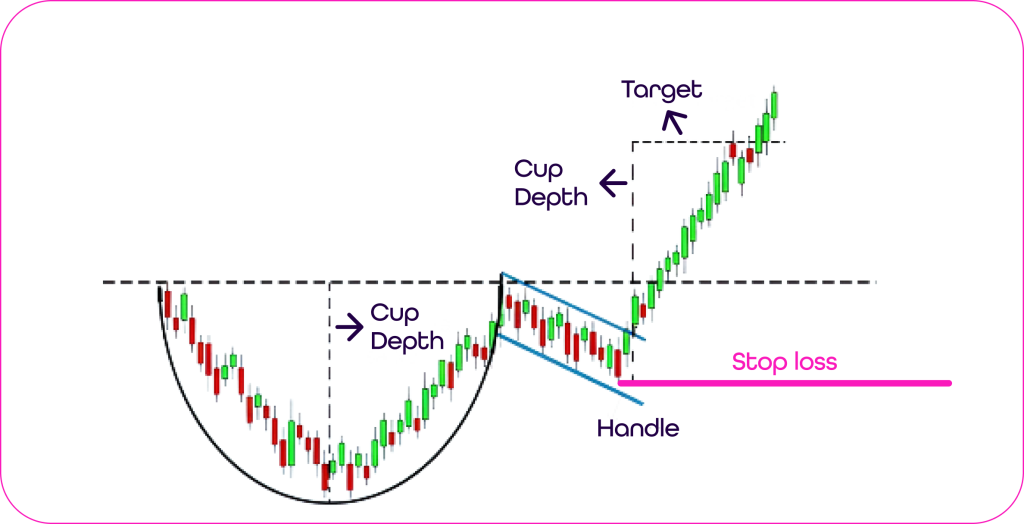

Stop-Loss

- Where: Just below the bottom of the handle, not the entire cup – that would be too far.

- Why: If the price breaks out but quickly falls back below the handle, the pattern has failed. Don’t wait around.

Take-Profit

There are two main options:

- Option 1: Measure the depth of the cup (from bottom to top), and project that distance upward from the breakout point. That gives you your classic breakout target.

- Option 2: Take profits in steps – for example, close 50% of the position at the first resistance, then move your stop-loss to break-even.

Example: If the cup has a depth of 100 pips, expect a potential move of about 100 pips above the breakout.

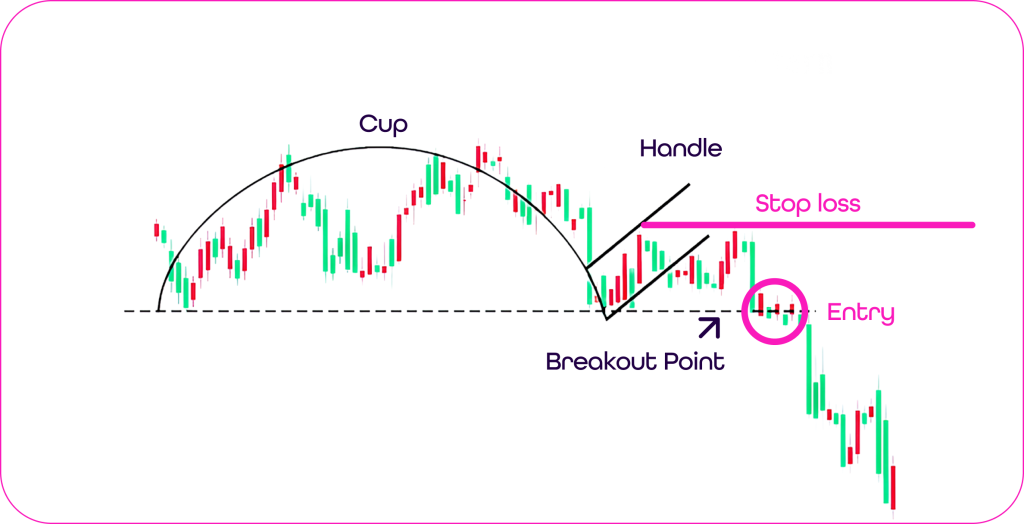

Inverted cup and handle pattern: When the market is falling

So far, we’ve covered the classic bullish version of the pattern. But there’s also a flipped version: the inverted cup and handle pattern. This variation appears in downtrends and signals a possible continuation of falling prices. Instead of a “U” shape, you’re looking for an upside-down arc.

What does the inverted cup and handle look like?

- The uptrend ends, and the price begins to fall gradually – forming an inverted cup.

- After a return to a previous support level, there’s a short pullback – the handle (usually a small rise).

- A breakout below the support level marks the sell signal.

Entry: below support

Stop-loss: above the top of the handle

Profit target: height of the pattern projected downward

Where does the inverted cup and handle work well?

- Forex (e.g. EUR/USD, GBP/JPY)

- Indices during corrections (e.g. Nasdaq)

- Crypto during sell-offs (BTC, ETH)

If you’re trading short positions or scalping downtrends, this pattern can help you time your entry more effectively.

How to practice trading the cup and handle pattern

Don’t expect to master this pattern overnight. But with the right training plan, you’ll improve much faster:

What to practice

- Spotting the pattern on different charts and timeframes

- Defining entry points, stop-loss and take-profit levels

- Backtesting the pattern on historical price data

Summary: Cup and handle belongs in every trader’s toolkit

The cup and handle pattern is a powerful trading tool, but it only works if you know exactly what to look for.

What should you take away from this article?

- The pattern must be confirmed – never trade it without a breakout.

- Always check volume, shape, duration, and market context.

- Don’t forget about the inverted version for short trades.

Practice on a demo trading account – improve your timing and patience.

Discover your talent for trading

Resources

Zhou, Y., 2023. Research on Cup and Handle Price Pattern Based on Svm Method. Highlights in Business, Economics and Management. https://doi.org/10.54097/hbem.v21i.13593.

Cooper, J., 2012. Anticipating the Next Move. , pp. 41-59. https://doi.org/10.1002/9781592805532.CH4.